We have been the only of biggest home loan review service inside Southern area Africa, therefore have matchmaking making use of the major financial institutions

When you are being unsure of how to apply for a mortgage and you may exactly what the procedure requires, our very own action-by-step book have a tendency to simplify the procedure to help you incorporate which have believe.

- Initiate our home application for the loan techniques because of the choosing what you can pay for.

- Check your personal credit record to choose your chances of having your financial recognized.

- Use a mortgage analysis solution instance evo Mortgage brokers so you can have the best package on your financial by submitting their application so you’re able to numerous banking institutions.

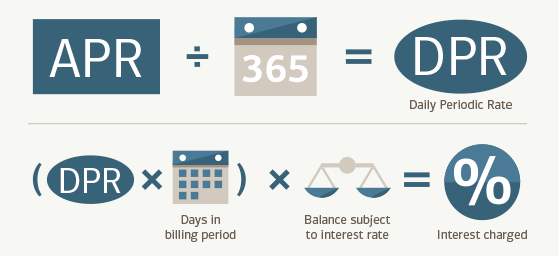

Very you have from owning a home a real possibility? Because you can observe, the house financing ‘s the means by which your fund good house buy. The financial institution, always a lender, has the funds to pay for household purchase, that you upcoming pay back within the month-to-month repayments together with focus.

However, maybe you may be not knowing simple tips to go about applying for a great home loan? Don’t be unnerved of the procedure. All of our action-by-step guide to home loan software shows just how basic easy it really is.

Rating prequalified having home financing with evo, following, when you’re ready, you could potentially get home financing with evo

- Determine what you could affordBefore getting into your house look, it assists to know just how much it is possible to qualify for.You can expect a free, online tool enabling one to do just that. Our very own Bond Calculator allows you to enter the month-to-month earnings, overall monthly expenses, together with label and interest rate of your mortgage; after that exercises that which you be eligible for and you will what your month-to-month payments will be based on that information.

- Rating prequalifiedPrequalification might leave you a concept of everything can afford, and provide you with a good prequalification certification that one can let you know to estate agents.It’s going to offer the personal New Jersey personal loans credit record, that’s useful because your credit record could be the extremely important factor your bank takes into account in relation to their mortgage software. That way, you should understand if or not you need to require some procedures to switch your credit record before applying.You can purchase prequalified around, either from the getting in touch with our prequalification gurus, otherwise that with our 100 % free, online prequalification unit.

- See a house you likeOf way, before you apply having home financing needed a house to help you get. An estate broker will be a very important assistant in helping your discover a property that meets your preferences.Make an effort to attend household viewings rather than counting on photographs regarding a house; so you can get a more perfect photo whilst getting an effective getting for just what it’s like to reside in the home.

- The deal so you’re able to PurchaseOnce you have receive the house you need, you need to concur words for the supplier. It is known as Provide buying, and you may signing they commits you to buying the assets.

- Fill out the required documentsNow that you’ve known the property you need and signed the deal to buy, it is the right time to initiate your house application for the loan processes. This requires one fill in lots of data on bank with which youre using. Such will become:* A copy of ID.* A copy of one’s Offer to get.* Proof of earnings.* 6 months value of financial comments.The lending company will determine your credit score to determine whether your financial will likely be recognized, and just how highest your rates will likely be in case it is.

- Play with a mortgage investigations serviceDon’t only connect with you to financial, affect numerous banking companies in order to discover those that render the best business.

Attempt with home financing review service, such evo Lenders. We could enable you to get an informed financial plan which have a minimal interest rates.

Get ready for the newest court processesThe lender commonly opinion their personal credit record when assessing your house loan application to help you see whether your residence loan would be accepted, and exactly how high their interest is going to be when it is.

The bank have a tendency to hire a bond lawyer to register the connection, and the possessions seller tend to hire the latest conveyancing attorneys to cope with the import out-of possessions.

Just be sure to spend the money for fees to the thread membership and transfer off property (and you can import obligations if your home is really worth over R1 000 000), thus remember this type of most costs.

You can utilize the Import Rates Calculator to determine what this new thread membership and you can transfer will set you back would be, based on the measurements of our home mortgage.

While merely considering to acquire a house, otherwise will be ready to setup an offer, evo will get the finest deal on your own financial for free. To really make the house-to purchase process that much easier, evo has the benefit of various home loan calculators to simply help make the family-to find techniques much easier.