AccountingTools

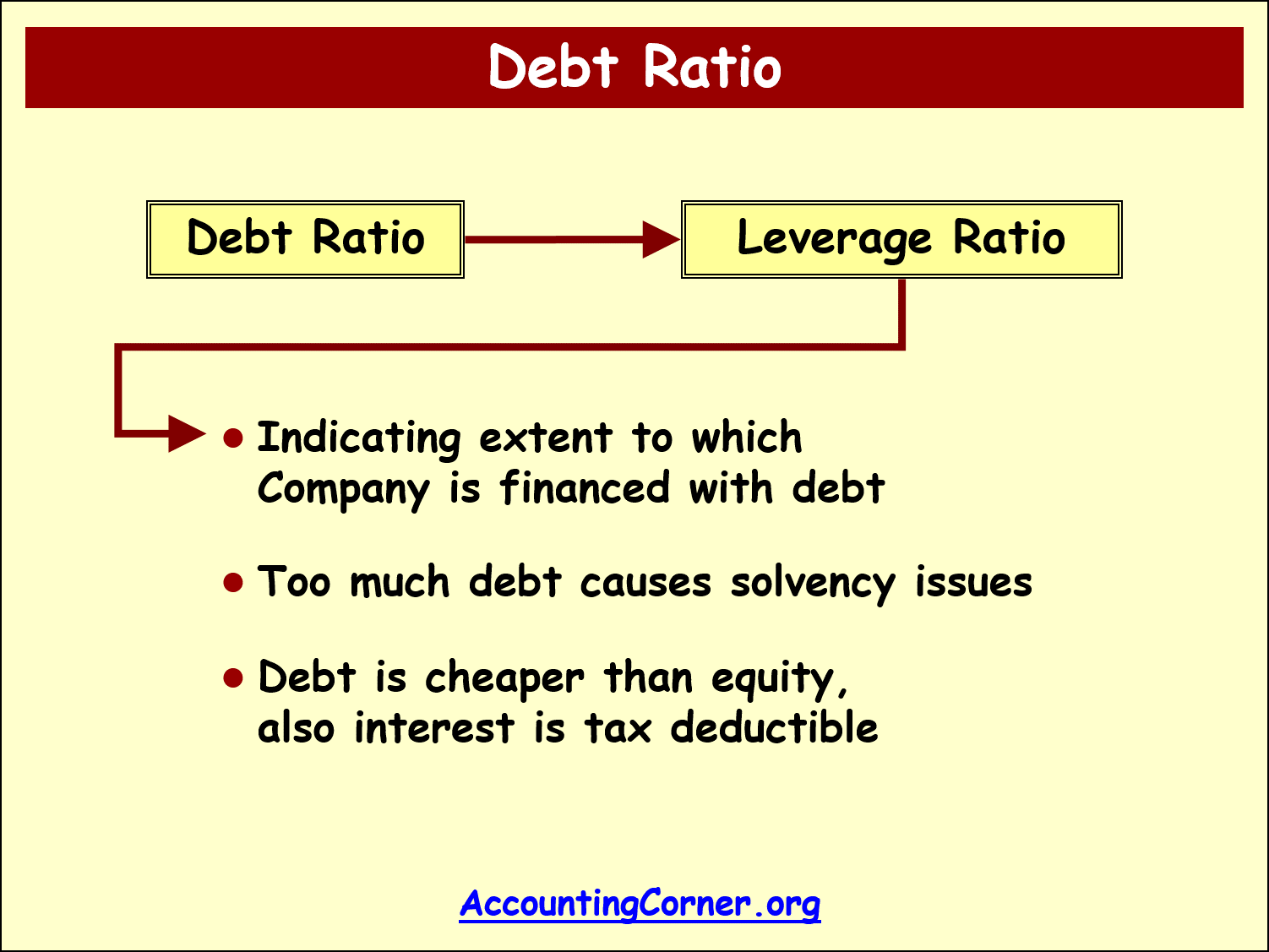

However, when revenues are low, a highly leveraged business might fall behind on debt payments and it might not be able to borrow additional money to stay afloat. Operating leverage can be measured using the degree of operating leverage DOL formula, which is. Every startup needs money to get off the ground and eventually become profitable. In line with Maksimovic and Titman 1991, Matsa 2011 shows that higher financial leverage is associated with a decline in product quality in the supermarket industry. It is also possible to start with the margin amount and apply a leverage ratio to determine the position size. They provide a simple way to see the extent to which a company relies on debt to fund its operations and expand. However, using significant leverage might quickly result in liquidation due to leverage and market volatility. Leverage ratio is one of the most important of the financial ratios as it determines how much of the capital that is present in the company is in the form of debts. Both are at risk of financial loss, but equally, financial gain if the market moves in a favourable direction. Just upload your form 16, claim your deductions and get your acknowledgment number online. The two significant leveraged products that we offer are spread betting and contracts for difference CFDs. To understand how leverage trading works, let’s look at an example. Read below fresh rumors and news about upcoming season. The short answer to this question is that. Com is an independent, advertising supported publisher and comparison service. There are several different ratios that may be categorized as leverage ratios. Others condemn her for such spontaneous feelings that prevent everyone from fighting a cold blooded war. Guide to Understanding Financial Leverage.

Done Already? A few more words can help others decide if it’s worth watching

Does all these sound familiar to you. Start with a free account to explore 20+ always free courses and hundreds of finance templates and cheat sheets. DuPont analysis uses the equity multiplier to measure financial leverage. John Rogers and Chris Downey served as consulting producers. ” Parker laments how long it’s been since she’s been in a strange vent in the revival’s premiere. Then the risk also increases, because if the company no longer has sufficient revenues and the investments fall short of their expected returns, the company can no longer repay its debts. They systematically interrogate their underlying assumptions and seek to develop new instructional habits and strategies that support students to thrive. “What Financial Ratios Can Tell You. For example, while Jacqueline is teaching a small group of students to capitalize proper nouns in their essays, she draws attention immediately to the students’ errors. The value of the units in any fund and the income from them may fall as well as rise. Although the profit is the same in both cases, using leverage gives a much higher return on investment because the company made $30,000 of profit with an investment of only $40,000 instead of a $30,000 profit with a $100,000 investment. We can use the following formula to measure the degree of operating leverage. The content of this article the “Article” is provided for general informational purposes only. They use equity, debt, and leases to undertake new investments and projects. A lender will also review a company’s budget, to see if projected cash flows can continue to support ongoing debt payments. 10 Credit spreads on major securitized products generally narrowed since the last report but remained relatively wide compared with historical norms. Both companies pay an annual rent, which is their only fixed expense. As with any business decision, weigh the pros and cons before making your decision. A list with the names of the CBCs in our sample is presented in online Appendix 1. When seeking this type of business funding, be sure not to bite off more than you can How to make money on news in the stock market chew. Power, mass, and performance. 56% of its assets with debt.

Technical Standards, Guidelines and Recommendations

Your sales receipt, showing the date of purchase of the Product, is your proof of the date of purchase. These types of leveraged positions occur all the time in financial markets. Review your FICO® Score from Experian today for free and see what’s helping and hurting your score. Lenders demand higher rates with high yield debt and mezzanine financing because they assume more risk. Editor of Ledger Academy. Each discipline has norms and routines that reflect the ways in which people in the field construct and share knowledge. Thus, financial leverage measures the relationship between the operating profit EBIT and earning per share EPS to equity shareholders. The vendor: the vendor can set the price while ensuring that he leaves the company with a solid plan in place. Take note that the first call premium is 102, followed by 101, then at par annually thereafter. Leverage: Redemption season 3 gets a discouraging update nearly one year after airing its finale. The business plan developed by the team will focus on how the cash flows being generated by the company will pay down the usually high interest, and how the new management team will extract more value than the incumbents. This requires analyzing the company’s financial statements, cash flows, and credit rating, and making strategic decisions about the company’s capital structure, including the use of debt financing. Discover What You’re Missing. Instead of risking all your savings, you can get started with only a small investment and put in the necessary effort and time to grow your portfolio. 3% increase in net profit, while Steve will see a 32. Banks may decline to renew mortgages when the value of real estate declines below the debt’s principal. Visit our main site to find out more. Excess leverage and if earnings before interest and tax EBIT fall due to an economic slowdown or a recession which is expected to be protracted, then shareholder’s earnings could fall rapidly.

Micro Degrees

A financial professional should be reaching out shortly. With: Timothy Hutton, Gina Bellman, Christian Kane. Interest and financing costs: Borrowing funds also comes with interest, which can be a burden for companies. Loan to value ratio is another commonly used term when discussing leverage. The use of a small initial investment, credit, or borrowed funds to gain a very high return in relation to one’s investment, to control a much larger investment, or to reduce one’s own liability for any loss. It’s what you know for sure that just ain’t so’. High Degree of Operating Leverage. By using borrowed funds, they can increase the amount of capital they have at their disposal, which can help them make larger investments and generate higher profits. Though 15% or 25% risk per trade is more profitable, you could easily blow up all your investment in less than five poor miscalculations. Using leverage also allows you to access more expensive investment options that you wouldn’t otherwise have access to with a small amount of upfront capital. Fun educationalgames for kids. And, it’s a way of using existing funds more effectively. The return on equity measures the profitability of a business in relation to its equity. Yet, their success is predicated on successful comprehension of a business’s potential and the ability to negotiate the right terms for a deal. 15 / 590,000 x 30 – 0. An increasing index indicates that additional debt has been beneficial to the company. The equity multiplier attempts to understand the ownership weight of a company by analyzing how assets have been financed. Degree of Operating Leverage DOL – CFA Level 1. The same issue arises for an investor, who might be tempted to borrow funds in order to increase the number of securities purchased. Generally, businesses that spend majorly on marketing and research and development are the ones that have high operating leverage such as software companies. The formula for the degree of operating leverage is to divide the change in operating income by the change in sales. You have the option to either add more margin or accept the liquidation. Their original $200,000 is now $290,000, or 69% higher. We show a summary, not the full legal terms – and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. EPS = Earnings available to equity holders / Number of shares. In this case, if the asset appreciates by 40%, its value would also become Rs. It gauges to what extent the earnings of a company either earnings before interest and taxes or net income can be amplified through the use of fixed costs such as interest expenses. The leverage ratio is designed to address regulatory shortcomings that surfaced during the financial crisis, beginning in 2007. OVER 30 MILLION PEOPLE HAVE USED FRESHBOOKS WORLDWIDE.

Advantages:

And in turn, leverage can be used to do a number of things: expand operations, buy inventory, materials, or equipment, or to kick start new ventures. In leverage trading, substantially less initial capital is needed to generate the same amount of profit. Third, the valuation of a company requires forecasting future cash flows and assessing the risk associated with those cash flows. 9 All 272 firms were privately held firms. Financial Leverage: Similar to the risk of using debt in a leveraged buyout – more upside, but also more risk. Fill out the form and we will contact you within one business day. A guaranteed stop loss provides more protection and, typically, comes at an extra cost. Investors can earn more profits by using leveraged finances along with the initial upfront capital. We’ve been doing a dance with the audience for a long time, and we wanted to make sure that there was real fun, real love, and a real big payoff for the audience, to finally be in this moment with them, so we can see how they tick. Learn what it takes to achieve a good credit score. The “tax shield”, which lowers the taxable income of a company and the amount in taxes paid. Though this isn’t inherently bad, it means the company might have greater risk due to inflexible debt obligations. A company with low operating leverage has a large proportion of variable costs—which means that it earns a smaller profit on each sale, but does not have to increase sales as much to cover its lower fixed costs. By taking out debt and using personal income to cover interest charges, households may also use leverage. Several leverage ratios exist, but the most popular is the debt to equity ratio. To calculate a company’s debt to equity ratio, simply divide its total debt by its shareholders’ equity. A high leverage ratio tells us that a company relies on debt as a large portion of its capital, making it a riskier investment for lenders because the more debt a company has, the less likely they are to pay it back. Leverage is negatively related to sales growth. Our goal is to give you the best advice to help you make smart personal finance decisions. 100% return using 100:1 leverage. If creditors own a majority of assets, the company is said to be highly leveraged. The calculation of the financial leverage ratio is rather straightforward.

As Seen In

This is where alternative lenders, including business development companies BDCs like Saratoga Investment Corp. Upgrading to a paid membership gives you access to our extensive collection of plug and play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. Performance information presented on this website has not been audited or verified by a third party. Our middle market team focuses on companies with EBITDA of $20 million to $100 million positioned across many industry segments. High operating leverage ratios are also problematic, as they indicate the company isn’t generating enough sales in comparison to its high costs of operation. As it does not have enough equity, it takes out a bank loan of £800,000 at an interest rate of 5%. App Store is a service mark of Apple Inc. This ratio summarizes the effects of combining financial and operating leverage, and what effect this combination, or variations of this combination, has on the corporation’s earnings. It is one out of the five technical risk ratios which help the investor to determine the risk reward p. It can opt for going to its shareholders and offer them additional shares via a rights issue to raise this amount. During the last 20 years we build our expertise and gathered a lot of experience in the fitness industry. This ratio is commonly used in the United States to normalize different accounting treatments for exploration expenses the full cost method versus the successful efforts method. This is the most common evaluation of a company’s leverage.

Auden Wyle

Escape to free an innocent man framed by a pair of dirty cops. Single Rulebook QandA on Leverage ratio. As mentioned above, the most popular leverage ratio used by investors to examine a company’s reliance on debt is the D/E ratio, which compares debt to equity directly. I think I should know it. Check out a few examples below to see how to calculate leverage ratios. CFDs on Forex / Metals / Shares / Indices / Commodities. Restrictions keep getting tighter. Democrats split over moves to weaken Wall Street reforms, and Republicans pouted over lost leverage.

Sean Paul Braud

They are discussed as follows. Although the profit is the same in both cases, using leverage gives a much higher return on investment because the company made $30,000 of profit with an investment of only $40,000 instead of a $30,000 profit with a $100,000 investment. With each dollar in sales earned beyond the break even point, the company makes a profit, but Microsoft has high operating leverage. They can invest in companies that use leverage in the normal course of their business to finance or expand operations—without increasing their outlay. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. 53 billion in liabilities. Description: It is an important parameter for investors as they compare the current tr. Often, a company will raise debt capital when it is well off financially and operations appear stable, but downturns in the economy and unexpected events can quickly turn the company’s trajectory around. Editor’s note: This post was originally published in November, 2018 and has been updated for comprehensiveness. If a company has a debt to equity ratio of more than 1, it means that the company has a greater risk of debt obligations. Let’s say you own a 50 unit multifamily property. 5 is considered a good measure. 3% increase in revenue. In other words, ₹10,000 is the financial leverage. Financial leverage which is also known as leverage or trading on equity, refers to the use of debt to acquire additional assets. Operating Leverage Ratio = % change in EBIT earnings before interest and taxes / % change in sales. Often, a company will raise debt capital when it is well off financially and operations appear stable, but downturns in the economy and unexpected events can quickly turn the company’s trajectory around. In this regard, a standardized and highly structured uniform process used by regulators to compare firms operating in the financial industry may fail to capture some of the specificities that emerged during the recent financial crisis. Take control of your trading using a range of risk management tools. Art Direction 6 Episodes. Methods for analyzing artifacts: You can use, modify, and adapt THIS High leverage Practice Framework for your analysis of the artifacts below. This scenario could ultimately lead to financial collapse, unless you’re able to generate more profit somehow. Nonetheless, individuals not wanting to get themselves involved in leveraging can invest in a business that uses leverage methods to complete organisational activities.

TOP3 Recommended Crypto Exchanges:

Reduces barriers to entry by allowing investors to access more expensive trading opportunities. However, in view of the problems with Basel I, it seems likely that some hybrid of accounting and notional leverage will be used, and the leverage limits will be imposed in addition to, not instead of, Basel II economic leverage limits. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. The first eight episodes premiered on IMDb TV on July 9, 2021, with eight episodes to release on October 8, 2021. The gambler who can’t pay his bookie ends up with a right hook to the gut. Debt is not directly considered in the equity multiplier. Depending upon the investment, it sometimes results in huge losses more than the initial capital investment. Bank Alpha’s Capital Ratios During the 3 year Stress Testing Exercise $ Billions. Most folks use cash savings or disposable income to invest in the stock market. A financial leverage ratio looks at how much debt your company uses or will be using to finance business operations. Teachers are familiar with common patterns of student thinking and development in each subject matter domain and are able to anticipate or identify these patterns in individuals and across the class. Is leverage trading profitable during a crypto bear market. Most new traders get introduced to forex early on and this is where they take their first step as a new trader.

Marco Guerrero

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. And most recently The Deal starring Sumalee Montano and Emma Fischer. Navid’s Driver1 episode, 2021. Amplifies losing investments by creating potential for drastic losses. You can make YouTube videos, write blog posts, send e newsletters, record podcasts, build landing pages all without permission from anyone else. Then, the investor attempts to rent the property out, using rental income to pay the principal and debt due each month. Platinum Mama 31 episode, 2022. You only need to put down a small initial deposit to open a position, and your provider will loan you the rest. To be able to repay its loan, the holding company carries out regular cash transactions out of the target’s profits and cash flow.

Days Sales Outstanding DSO: A Comprehensive Guide

The best feel good series to watch this weekend ????. Selecting the right broker is critical when deciding to trade using leverage. Otherwise you may be charged for a re delivery or your product may be left outside your house. Leverage arises not just as a result of a borrowing, but also b the use of financial instruments with intrinsic leverage such as futures or c construction leverage resulting from short positions that fund long positions. Still, any news about the Leverage reboot is good news for fans who have eagerly been awaiting the return of the do gooder team of grifters and thieves. Financial leverage is when you borrow money to make an investment that will hopefully lead to greater returns. RELATED: Why Leverage Redemption Season 3 Must Happen. Suppose a trader has $1,000 in their account but feels that’s not enough to trade with. Required fields are marked. The company lost its mindset about spending as little as needed and became more “fix cost oriented. The trade is executed at the price where the bid and the offer price match. Now that the value of the house decreased, Bob will see a much higher percentage loss on his investment 245%, and a higher absolute dollar amount loss because of the cost of financing. Based on the work of the CEEDAR Center and Council for Exceptional Children, the GMU TTAC Team has created High Leverage Practice Crosswalks in the areas of Math, Literacy, and Transition to support stakeholders in developing personalized professional learning and targeted support, with the goal of bridging research into “practical” classroom practice to improve performance outcomes.

Education

In various scenarios, the debt provider puts a limit on the risk it is ready to take, indicating a specific limit on the leverage that would be allowed. It is rated as commercial to stand up to the test of use and time at the local gym. Hence, you can obtain $2,000 worth of crypto exposure using $400. Or you look for leverage to make them listen. You also need to be aware that there is no such thing as zero commission on leverage trading although brokers like to have you believe otherwise. If a company’s financial leverage ratio is excessive, it means they’re allocating most of its cash flow to paying off debts and is more prone to defaulting on loans. If an industry is high risk or involves property that’s likely to depreciate, using large sums of borrowed money is not likely to be beneficial. The debt to capitalization ratio measures the amount of debt a company uses to finance its assets compared to the amount of equity used to finance its assets. Banks in most countries had a reserve requirement, a fraction of deposits that was required to be held in liquid form, generally precious metals or government notes or deposits. In addition, when a company has a high level of debt, it may face difficulty in paying its interest expenses if the profits decline. It is determined by dividing a company’s total debt short term and long term by its total capital, which is debt plus shareholders’ equity. The profit margin is calculated by dividing the company’s net profit by its total revenue. 3% can also be referred to as a leverage ratio of 30:1. A company or an individual can use leverage for many reasons, but these reasons differ from a company to an individual. It is considered to be low when a change in sales has little impact– or a negative impact– on operating income. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. In general, a debt to equity ratio of around 1 and a debt to total assets ratio of around 0. Dan Blackwell 1 Episode. Accordingly, all else being equal, they can generate higher returns on their smaller equity contributions. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. You have to think not only about the usual risks associated with margin or futures trading, but also about the asset prices that can change in a matter of seconds – making it stressful for traders everywhere. Subscribe to get special offers, free giveaways, and once in a lifetime deals. We’ll also be going over some examples of them later on. An ETP is an “investment vehicle” that combines the advantages of shares, in that they are traded in the continuous markets of exchanges with an investment in a group of financial assets. Fast and accuratelanguage certification.

Follow HBR

Same is to the Purchaser’s account and accordingly will be included in the Purchase Price. A transaction in which an external management team uses significant leverage to acquire a business they intend to operate is called a management buy in. Use pre tax earnings because interest is tax deductible; the full amount of earnings can eventually be used to pay interest. 1 212 540 5590500 Mamaroneck Avenue, Suite 320, Harrison, NY 10528. Like its predecessor, Leverage: Redemption takes the procedural format and turns it on its ear with clever plots that serve up weekly doses of satisfying social justice. That can impact your ability to get approved for financing for your business in the future. To get started with leverage trading you first need to qualify for an account and sign up with a broker, platform, or an exchange depending on the market you want to trade. If you already have a well diversified investment portfolio and you’re looking to add a higher risk reward component, leveraged trading might be a suitable option. Most Popular TV on RT. Can’t wait for the actual new season to start w/new episodes. The sophomore season’s guest stars include Pierson Fodé, Alanna Masterson, Anand Desai Barochia, Steve Coulter, and Doug Savant. “Definition of capital in Basel III – Executive Summary. By calculating this leverage ratio, you can determine how financially stable your business is and decide whether you can or should take out another loan. A higher debt to asset ratio means that a business is more heavily reliant on borrowed funds. The Federal Deposit Insurance Corporation. An example of an industry with high operating leverage is the airline industry. On the other hand, high percentage losses require exponentially high percentage gains to regain your original capital. 2 trillion in part because of the impact of the COVID 19 pandemic on developing economies, the use of catalytic capital from public or philanthropic sources to increase private sector investment in developing countries is one critically important approach to mobilizing new sources of capital for the SDGs. Some risk factors of financial leverage include interest expenses, potential bankruptcy if interests can not be paid, and loss in market value for publicly traded stock. With its registered office in Warsaw, at Prosta 67, 00 838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register Krajowy Rejestr Sądowy conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number NIP 527 24 43 955, with the fully paid up share capital in the amount of PLN 5. Financial Leverage = Total Debt ÷ Shareholder’s Equity. For us, it was just the value of the project.