As much readers discover, I am a beneficial proponent of keeping an untapped household collateral line of borrowing from the bank (HELOC) inside my fingertips to own significant emergencies. This is not my emergency funds. Its what i phone call my personal disaster financing.

We have usually considered that keeping good HELOC offered ‘s the most useful insurance policy in addition to right back-up policy for if the / when the crisis finance operates blank. Remember it’ being able to tap so it money you will purchase you amount of time in the event off long term work loss or infection. And you may date is actually currency.

Whenever we bought our home 3 years back, we set $three hundred,100 down on new $step 1,a hundred,one hundred thousand price. This was over 25 % of its really worth and you will thought practical on time regarding no-off money. This amount offered all of us http://www.paydayloansconnecticut.com/waterbury a nice amount regarding guarantee in our house. I actually wanted to lay a whole lot more down, however, the mortgage broker recommended otherwise. Her pointers are that we might be starting wiser one thing having which money’ like in to find extra property (dollars positive rental characteristics, an such like.) or other longterm assets.

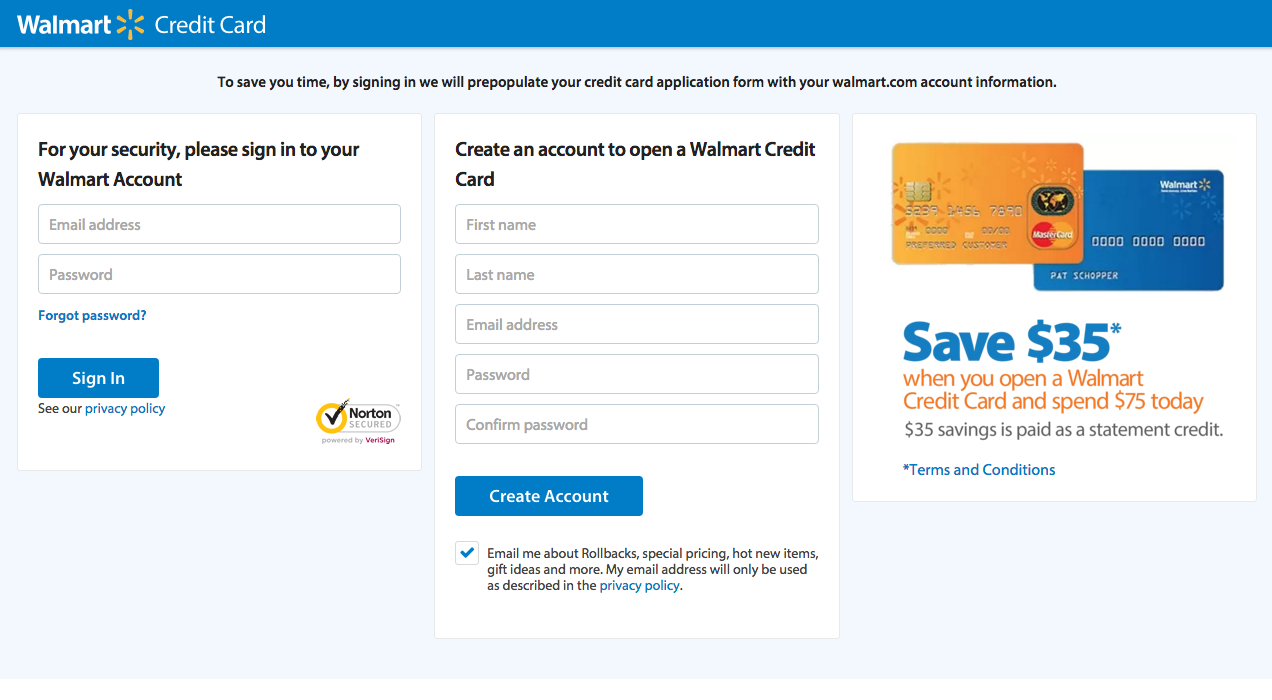

After i bought our home, the large financial company got us refinance and then have a line of borrowing from the bank off Citibank getting $168,one hundred thousand. I’ve never ever used it.

Of course the fresh urge is obviously truth be told there. We desired to redesign our kitchen because the big date you to definitely, but Jeanine and i also concurred we’d waiting and you can spend dollars to have so it enterprise (projected in the $forty five,000). Our very own bucks visited other tactics last year’ particularly the newest $55,100 invested attempting to make an infant. This year, it could be some other $25,100000 $30,one hundred thousand to consider an infant. We shall feel living with the existing kitchen to own a long time.

We identify all the newest financial facts to support my personal religion that we have been in control consumers. This new HELOC will there be purely because the a backup package. To have a tragedy. Several months. End regarding facts. But with having said that, You will find constantly checked out you to definitely personal line of credit as my money. Currency I’m able to access at any time.

History month, I penned about Nationwide suspended the HELOC on a single regarding my local rental properties there had been more than a few interesting comments I concurred with:

Countrywide got paid to open the latest account, paid religiously to my mortgage and the equity range and even got my money ahead of I’d was in fact contractually necessary to pay they. We, concurrently, features sacrificed the chance to favor how exactly to purchase my money, abandoned an economic pillow, and certainly will now need to completely rethink my personal monetary planning. Personally i think such as a good chump!

For this reason refuse, your house’s worthy of don’t aids the modern credit limit getting your home collateral credit line

However,, the higher state when i view it is that Nationwide (and any other financial for that matter) thinks they could freeze guarantee traces on usually with no supporting paperwork away from a beneficial property’s reduction in worthy of.

I am not arguing toward simple fact that the root security out of good HELOC is the home and so the financial has the correct (thus obviously stated in brand new fine print) in order to suspend usage of these types of fund. Alive and you can understand. My local rental property in Phoenix on Countrywide loan did during the facts reduced amount of worthy of. It decline does not matter provided I am investing a house getting the fresh new longterm. We have always bought on the purchase and you will hold approach. With the exception of you to definitely absolutely nothing head to repairing and you can flipping several years back. Which was the latest flip you to flopped. Real time and discover.

Furthermore, We have complete the majority of things best and for 40, I’m inside the an effective set financially. I’ve constantly believed my personal top home becoming certainly my very good assets. So it showed up as a surprise yesterday whenever we had new page regarding Citibank about the $168,100000 credit line:

We have concluded that home values near you, as well as your domestic value, has actually significantly denied. Ergo, we have been decreasing the borrowing limit for your house collateral line off borrowing, effective , to help you $10,100. Our reduced total of their credit limit is subscribed by the range from borrowing from the bank arrangement, government law and you can regulatory guidelines.

The thing i am understanding now appears to say this will be riskier than simply I was thinking in case your lender you are going to won’t stretch funds while they in earlier times conformed

However, I’m getting in touch with her or him today to conflict it. As to why? Given that in place of the newest Phoenix assets, I believe I am able to show the house provides retained its value and you may have not denied. I’ve an effective Newport Coastline address but are now living in just what I would identify due to the fact lowest lease district of the town. It’s for the cusp from Eastside Costa Mesa and that i faith the lender is using comps away from Costa Mesa getting assessment.

One of the reasons we sold in Newport is because we believed you to possessions beliefs do maintain their worth through the years. After all, exactly how many people know off Costa Mesa? But the majority folks have been aware of Newport Beach. It’s noticed desirable. Somebody want the brand new Newport Coastline target. Because a residential property declines, it can decline quicker in the Costa Mesa. And is.

But Newport hasn’t refused having any benefits if in case i examine current comps within our area code, we could convince the financial institution which our home have employed its well worth. Approximately which is my personal bundle. I’m going to combat this you to definitely and you will I’ll develop a take upwards article on my personal profits otherwise incapacity with respect to the dispute.

More from the home loan posts, there is far talk out-of loan providers limiting credit, for even finest borrowers. Among my personal Flames preparations might have been to shop for tax advantaged membership and you will pay my personal mortgage and also at an equivalent go out remain a beneficial HELOC having a prospective way to obtain disaster finance would be to it ever before be required. So is this however a practical package, if your bank get unilaterally change the agreement? By continuing to keep a comparatively small emergency finance in the bucks, I believe such I am getting my personal money to the office someplace else, but nevertheless have the HELOC to fall back to your is always to an excellent huge emergency occur.

If this sounds like genuine condition, then maybe I ought to divert anything now repaying this new financial on a more impressive cash disaster loans, in which case reluctant to added the fresh new dollars compared to that, in the event it seems the fresh new HELOC really should be doing so occupations, but may I absolutely rely on this new HELOC. We never ever heard about banking institutions not wanting to increase borrowing from the bank lower than an enthusiastic agreement they had currently made, but somebody perform be seemingly reporting you to definitely going on.

I will notice it would be better to accumulate the latest coupons. But what could be the odds I must say i need this much protection? Can it be to get preferred having finance companies to help you withhold HELOC?

I glance at an excellent HELOC since one among several exchangeability options that we are apt to have in line at any given time. Often have a chunk of money, specific Cds I will break, unexploited credit cards, margin mortgage supply, plus the HELOC. In case your commode strikes the latest windmill, at the least these choices is stolen.