To cover the company’s fixed cost, this portion of the revenue is available. After all fixed costs have been covered, this provides an operating profit. This is because the contribution margin ratio lets you know the proportion of profit that your business generates at a given level of output. So, you should produce those goods that generate a high contribution margin. As a result, a high contribution margin would help you in covering the fixed costs of your business.

Company

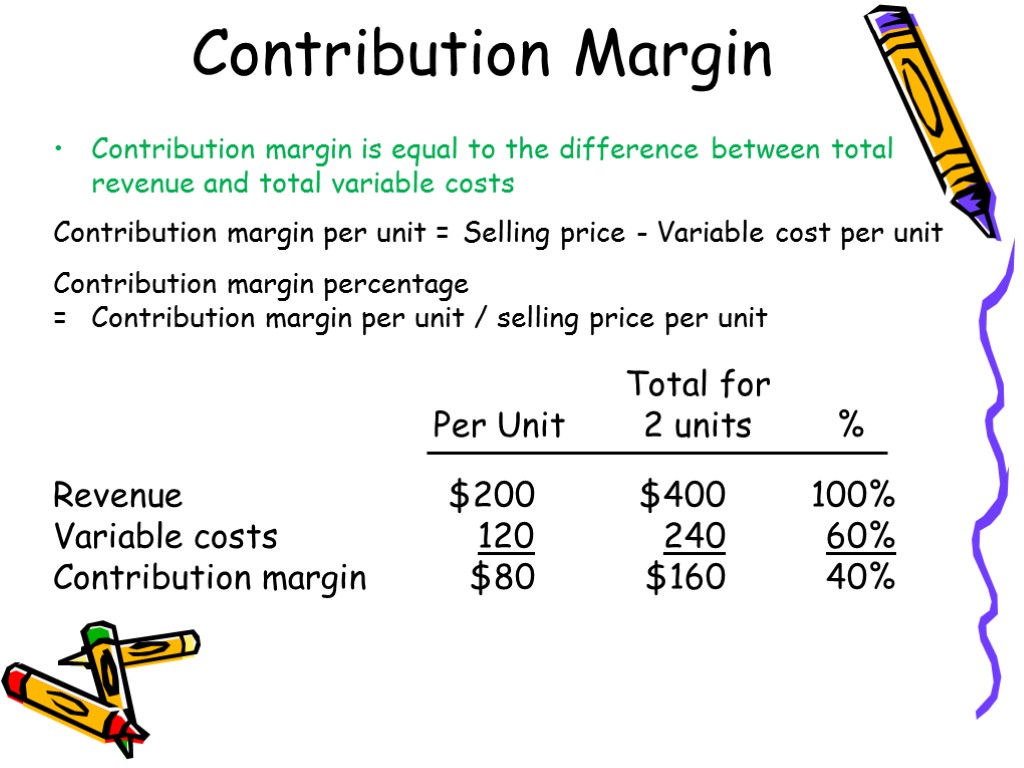

Using this formula, the contribution margin can be calculated for total revenue or for revenue per unit. For instance, if you sell a product for $100 and the unit variable cost is $40, then using the formula, the unit contribution margin for your product is $60 ($100-$40). This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit. Let’s examine how all three approaches convey the same financial performance, although represented somewhat differently.

Contribution Margin Ratio: Definition, Formula, and Example

Before making any changes to your pricing or production processes, weigh the potential costs and benefits. The contribution margin is important because it gives you a clear, quick picture of how much “bang for your buck” you’re getting on each sale. It offers insight into how your company’s products and sales fit into tax reform and the change to irs code section 1031 like the bigger picture of your business. If the contribution margin for a particular product is low or negative, it’s a sign that the product isn’t helping your company make a profit and should be sold at a different price point or not at all. It’s also a helpful metric to track how sales affect profits over time.

Total Cost

- If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred.

- This is because fee-for-service hospitals have a positive contribution margin for almost all elective cases mostly due to a large percentage of OR costs being fixed.

- The following are the disadvantages of the contribution margin analysis.

- This, in turn, can help people make better decisions regarding product & service pricing, product lines, and sales commissions or bonuses.

- Here’s an example, showing a breakdown of Beta’s three main product lines.

- Variable costs are not typically reported on general purpose financial statements as a separate category.

When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio). On the other hand, the gross margin metric is a profitability measure that is inclusive of all products and services offered by the company. In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential. Fixed and variable costs are expenses your company accrues from operating the business.

Total Variable Cost

For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs. The contribution margin is important because it helps your business determine whether selling prices at least cover variable costs that change depending on the activity level. Knowing your company’s variable vs fixed costs helps you make informed product and pricing decisions with contribution margin and perform break-even analysis. As mentioned above, the contribution margin is nothing but the sales revenue minus total variable costs. Thus, the following structure of the contribution margin income statement will help you to understand the contribution margin formula. Contribution margin (CM) is a financial measure of sales revenue minus variable costs (changing with volume of activity).

How is contribution margin calculated?

In the Dobson Books Company example, the contribution margin for selling $200,000 worth of books was $120,000. Now, let’s try to understand the contribution margin per unit with the help of an example. Variable Costs depend on the amount of production that your business generates. Accordingly, these costs increase with the increase in the level of your production and vice-versa. This means the higher the contribution, the more is the increase in profit or reduction of loss.

It also helps management understand which products and operations are profitable and which lines or departments need to be discontinued or closed. Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits. The contribution margin tells us whether the unit, product line, department, or company is contributing to covering fixed costs. Now, add up all the variable costs directly involved in producing the cupcakes (flour, butter, eggs, sugar, milk, etc). Leave out the fixed costs (labor, electricity, machinery, utensils, etc).

A university van will hold eight passengers, at a cost of $200 per van. If they send one to eight participants, the fixed cost for the van would be $200. If they send nine to sixteen students, the fixed cost would be $400 because they will need two vans. We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be $200. If they exceed the initial relevant range, the fixed costs would increase to $400 for nine to sixteen passengers.

These include variable manufacturing, selling, and general and administrative costs as well—for example, raw materials, labor & electricity bills. Variable costs are those costs that change as and when there is a change in the sale. An increase of 10 % in sales results in an increase of 10% in variable costs. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior.

This is one of several metrics that companies and investors use to make data-driven decisions about their business. As with other figures, it is important to consider contribution margins in relation to other metrics rather than in isolation. Profit margin is calculated using all expenses that directly go into producing the product. Fixed costs are costs that are incurred independent of how much is sold or produced.