This present year, The newest GM received AmeriCredit Business, and you can renamed they General Vehicles Financial Organization, a subsidiary now competing having GMAC/Ally Financial. GM set in the fresh new rebuilding of the very own lending business whenever GM Financial bought Ally’s global automobile credit procedures inside 2013, apparently increasing the size of GM’s during the-domestic financial. Based on GM, GM Economic now offers money for around 80% from GM’s internationally conversion process. 23 Likewise, Chrysler lso are-founded an effective unit that provides flooring plan financing in order to its buyers, unlike playing with Friend Economic. 24

Friend previously had popular lender arrangements that have Chrysler and you will GM, but these expired from inside the , respectively. They will continue to support car capital for the one or two Detroit automakers, but rather than an exclusive agreement to invest in the particular automobile transformation incentive applications. twenty five

As of , Friend Financial was this new 19 th -prominent You.S. bank carrying team, with just as much as $149.dos mil as a whole assets. twenty-six Within the yearly processing to your SEC in early 2014, twenty-seven Friend advertised about three significant lines off organization:

- Dealer Financial Properties. These services become motor vehicle financing and you will insurance policies, getting loans, rentals, and you may commercial insurance coverage to 16,000 vehicles traders and you may 4 million merchandising consumers. This type of businesses had $116.4 million off assets and you will made $4.seven billion of complete net money into the 2013.

- Mortgage loans. GMAC/Friend Monetary usually had tall home loan operations, but Ally Economic exited the enormous servings of the residential financial functions to your ResCap bankruptcy proceeding filing along with the divestment out of almost every other mortgage money affairs. The brand new bankruptcy legal affirmed the brand new case of bankruptcy package from inside the . Ally’s mortgage surgery got $8.2 mil away from property into the , and you may produced $76 billion off total websites cash from inside the 2013.

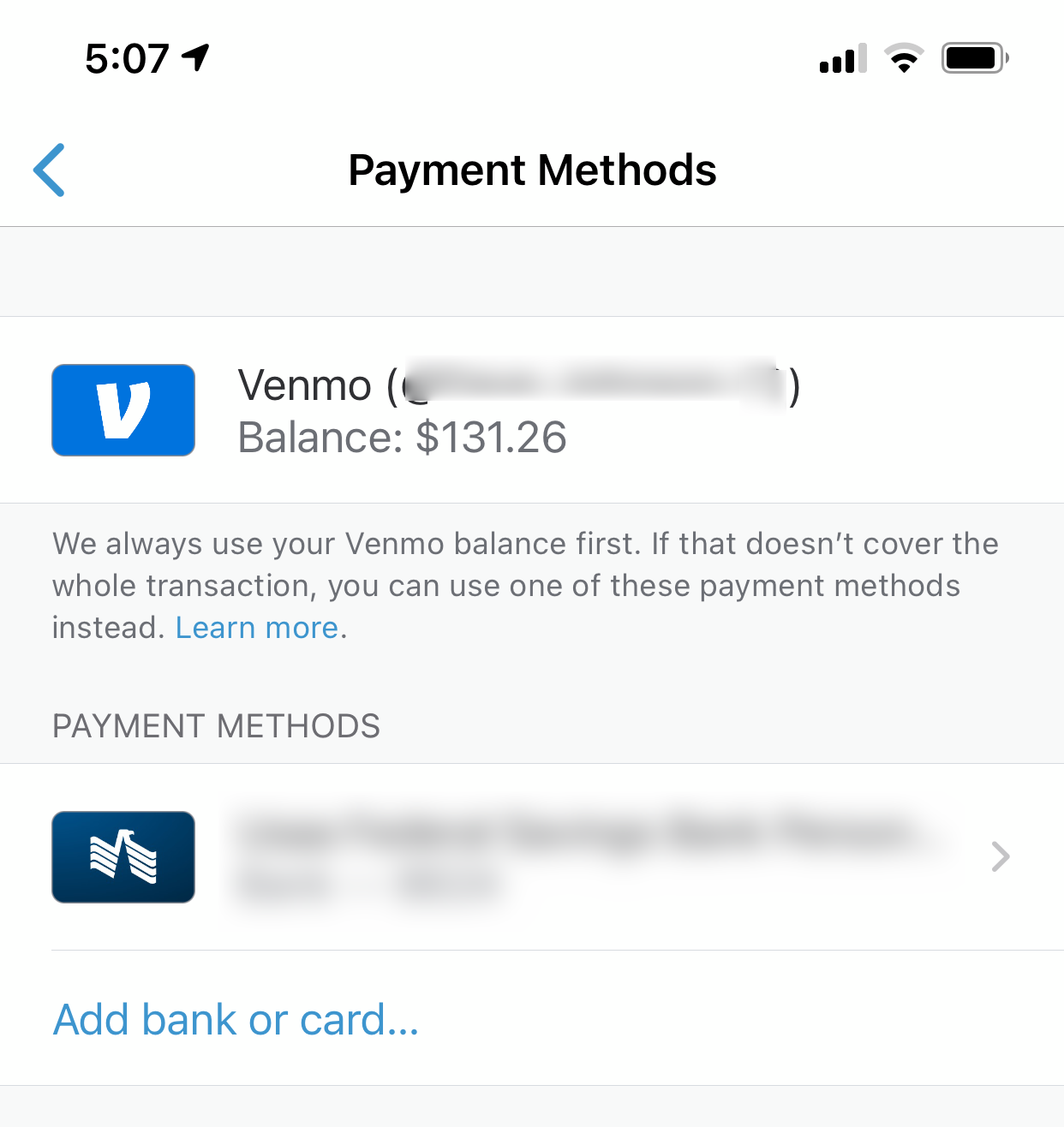

- Depository financial. Friend Bank introduces deposits through the internet, cell, cellular, and you will post channels. Their user financial activities include savings and money market profile, certificates out of put, interest-results examining accounts, and you will individual retirement levels. After 2013, it got $52.nine mil of places, in addition to $43.2 mil away from retail dumps.

GMAC/Ally Financial’s earlier in the day role because the home financing servicer triggered after that relationships that have TARP because providers took part in brand new TARP Domestic Sensible Amendment Program (HAMP). GMAC/Friend Economic has experienced just as much as $96 mil within the servicer added bonus money for doing HAMP. 28 The business confronted issue to have papers activities in property foreclosure legal proceeding and you can advertised a beneficial $230 mil charge towards organizations 2011 money on account of property foreclosure-associated grievances. 30

Government Recommendations getting GMAC/Ally Monetary

GMAC/Ally Monetary gained regarding one another general and you will certain regulators recommendations throughout the brand new economic crisis. Particularly guidelines integrated (1) Federal Put aside financing establishment, in which an organization you may borrow money in the Given inturn for less water bonds; (2) brand new FDIC’s Short-term Exchangeability Ensure System (TLGP), hence claims financial obligation issued of the financial institutions; and you can (3) the TARP, and that mainly considering even more financial support to bolster the business’s balance piece.

Federal Set aside Guidance

Historically, the fresh new Fed declined to recognize personal organizations that they lent money. GMAC alone, however, stated that at the conclusion of 2008, it got $7.six billion a fantastic regarding Fed’s Commercial Report Financing Business (CPFF). 30 The Dodd-Honest Wall Street Change and you may User Protection Work, 31 passed into the , called for the new Given so you can detail their crisis credit through the monetary crisis; details of such as lending was in fact create into the late 2010. It discharge did not is borrowing regarding low-crisis institution, for instance the dismiss windows. Desk dos summarizes everything put out by Government Reserve out-of GMAC/Ally Financial’s borrowing from the bank about CPFF in addition to Identity Market Facility (TAF). 32

The new Bush and Obama Administrations utilized the Troubled Advantage Save System (TARP) to include guidance into U.S. automobile industry, concluding your inability of 1 otherwise a couple of highest You.S. automakers create produce more layoffs simultaneously from already large unemployment, prompt difficulties and problems in other components of the savings, and you will disturb almost every other areas. The choice to help the car globe wasn’t versus conflict, that have issues raised as to what courtroom basis for the help together with way that it actually was achieved. The fresh almost $80 billion when you look at the TARP guidance to your vehicle globe included as much as $17.2 million getting GMAC installment loans online Louisiane, and that altered the name so you’re able to Friend Monetary in 2010.

When Congress failed to citation vehicles industry financing regulations, 3 the fresh George W. Bush Government turned to new Stressed House Recovery Program (TARP) to cover guidelines both for automakers and also for GMAC and you may Chrysler Economic. TARP was created by the fresh Crisis Monetary Stabilizing Operate 4 (EESA) into address brand new overall economy. It law specifically authorized this new Assistant of the Treasury purchasing troubled assets from “however this is,” the definition of and therefore didn’t particularly speak about development people otherwise vehicles financial support organizations. 5 Law enforcement within this EESA had been most wide, and you will both the Bush and Obama Administrations put TARP’s Motor vehicle Industry Capital Program to provide financial assistance in the course of time totaling more than $80 mil towards one or two producers and two finance companies. That it assistance wasn’t instead debate, and you will concerns was indeed raised regarding the judge reason for the assistance and also the method in which it had been accomplished. 6

Background to your GMAC/Friend Financial

Following bodies advice and you may restructuring of one’s car community, GMAC/Friend Economic given the majority of a floor plan and merchandising money for new GM and you may This new Chrysler. The relationship among the people, not, has been doing flux.